The price of any asset is always influenced by a combination of factors. Unlike traditional financial assets, bitcoin has historically had its own set of factors affecting its price. Do things look different now? Let’s find out.

Basic factors: supply and demand

The price of Bitcoin is highly dependent on fluctuations in supply and demand, just like other assets. However, unlike fiat currency metrics, bitcoin’s supply is always known and its hard cap is set at 21 million coins.

Demand for bitcoin is always high on the agenda in the cryptocurrency world – which is why BTC adoption is so talked about. Higher demand will cause its price to rise, especially when institutional investors get involved.

For example, when businesses and institutions began buying and holding bitcoin in early 2021, its price rose dramatically as demand outpaced the rate at which new coins were released for sale, which resulted in a decrease in the total available supply of the cryptocurrency. .

Its price will drop, however, if there are more people who want to sell it.

Institutional adoption

The news influences investors’ perception of Bitcoin in a major way.

Despite the extreme volatility in bitcoin’s price, 2021 stands out for its unprecedented adoption by institutions and businesses.

For example, Grayscale Bitcoin Trust had an average AUM of $31 billion and an average Bitcoin holding of 650K in 2021.

Crypto regulation

The Bitcoin price is also affected by regulatory developments. Regulatory changes can encourage or discourage investment in or use of BTC, which in turn leads to an increase or decrease in its price.

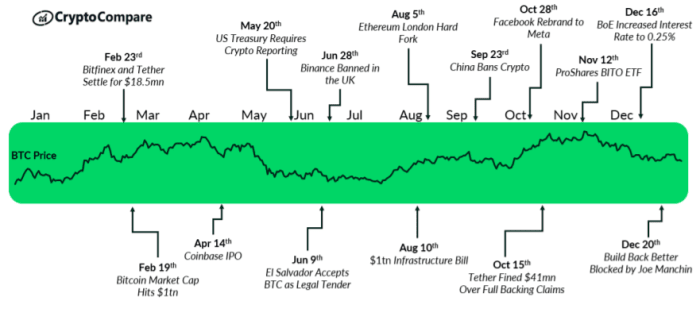

Here’s what bitcoin price looks like overlaid on regulatory events in 2021:

News indirectly related to Bitcoin

Consider an example of how indirect news events, such as news reports about a political situation in a country somewhere in the world, can have a substantial impact on the price of BTC.

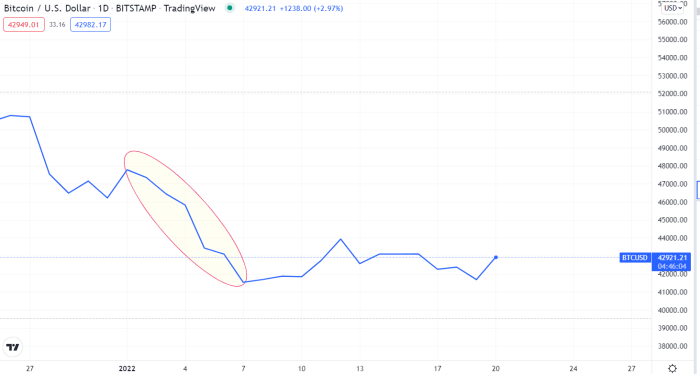

On January 2, 2025, a week-long uprising began in Kazakhstan. Most people did not realize the significance of this event for the crypto market. In recent years, Kazakhstan has become the world’s number two bitcoin miner based on hash rate. It accounts for around 18% of the global hash rate and is second only to the United States.

So, with the news of an uprising, it took around 24 hours for the crypto market to react, and the price of BTC fell 13.1% from January 2-8.

BTC Looks More and More Like Traditional Assets

In theory, traditional market-related news such as macroeconomic environment reports or central bank monetary policy decisions should not affect cryptocurrencies due to their decentralized nature. However, the current trend suggests otherwise.

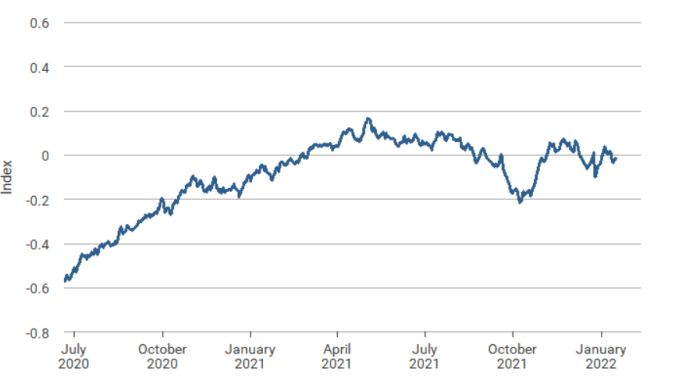

According to a study by the World Bank, the climate of global news has a significant impact on equity returns around the world. This effect is not reversible in the short term, suggesting an underlying source of sentiment-driven asset price swings.

Below is the Federal Reserve Bank of San Francisco’s Daily News Sentiment Index, which provides an overall measure of economic sentiment by analyzing news articles:

Although Bitcoin is not a traditional asset, it seems that the general sentiment of the news influences its value.

Here’s what the bitcoin price chart looks like when combined with the news sentiment index for the same time period:

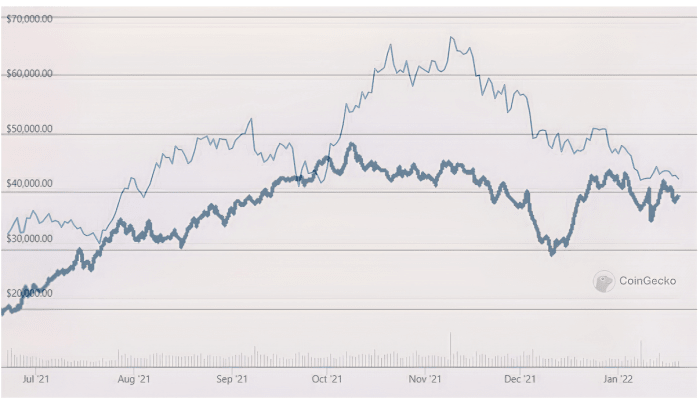

Recent data on the correlation between Bitcoin and major stock indices also suggests this.

Historically, crypto assets have not shown a strong correlation with major stock indices. In the latest data from Coinmetrics, however, the daily correlation between bitcoin and the S&P 500 rose to 0.47 on January 28, 2025, indicating a close correlation.

Conclusion

As the crypto market matures, new trends are emerging that we haven’t seen before. Initially a fringe asset, bitcoin now acts more and more like a traditional asset, susceptible to the same market forces that affect these markets. In addition to news about crypto regulations and institutional adoption, the price of bitcoin is affected by changes in general economic conditions and world events that impact traditional markets.

This is a guest post by Mike Ermolaev. The opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.