The text below is from a recent edition of Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

January was another kind of positive “up and to the right” month for major listed miners across their bitcoin holdings and hash rate. This group of eight miners now holds 36,159 bitcoins, up 12.35% from December 2021. production, investor presentations and press releases when available.

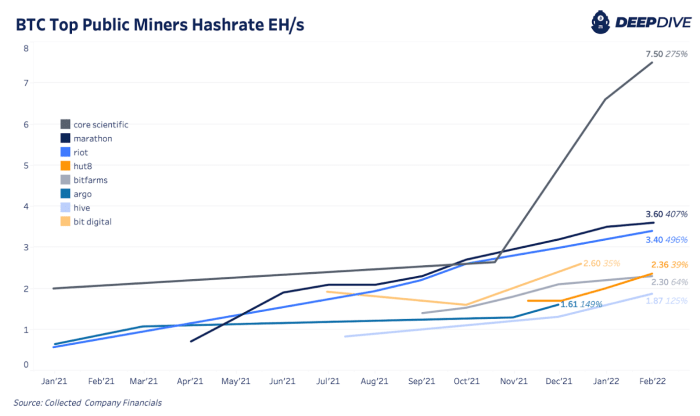

Like bitcoin holdings, hash rate capacity continues to grow for all miners. The biggest month-over-month change in hash rate came from Core Scientific, which jumped from 6.6 PE/s to 7.5 PE/s in December. The current hash rate is 2.84x compared to the 2.64 EH/s they had in October 2021. They are now leading public bitcoin miners in terms of hash rate capacity.

This hash rate includes a fleet of 75,000 leading ASIC machines that produced over 1,000 bitcoins for the month. In 2023, Core Scientific has approximately 90,000 additional machines under delivery contract.

Trading under the symbol $CORZ, Core Scientific went public last month on the Nasdaq. It currently has a market capitalization of $3.6 billion, making it the largest public miner in the market. Marathon’s market capitalization is currently $2.84 billion. Like most mining stocks, Core Scientific is highly correlated to bitcoin with a 14-day rolling correlation coefficient of 0.74.